9 Simple Techniques For Offshore Company Formation

Table of ContentsWhat Does Offshore Company Formation Do?Offshore Company Formation Fundamentals ExplainedWhat Does Offshore Company Formation Mean?The smart Trick of Offshore Company Formation That Nobody is Talking About

Hong Kong permits development of offshore firms and offshore checking account if your company does not trade in Hong Kong area. Additionally, in this situation, there will be no corporate tax obligation used on your profits. Offshore firms in Hong Kong are eye-catching: steady jurisdiction with excellent reputation and a reliable overseas financial system.

There are no clear distinctions due to the specific corporate legislations of each nation, normally the primary differences are tax structure, the level of discretion and property defense. Several nations want to bring in foreign firms and also investors by presenting tax obligation legislations friendly to non-residents as well as international companies. Delaware in the United States for instance is traditionally among the greatest tax obligation places in the world.

Offshore tax havens are typically classified as a means for tax obligation evasion. This is typically as a result of their rigorous privacy and also asset defense legislations as they are not bound to report or disclose any kind of info to your nation of home. However, that does not imply you do not have to follow laws where you are resident in terms of financial reporting commitments.

Some Known Details About Offshore Company Formation

The term offshore refers to the business not being resident where it is formally included. Moreover, frequently much more than not, the directors and also various other members of an offshore firm are non-resident also adding to the firm not being resident in the nation of enrollment. The term "offshore" might be a bit complicated, due to the fact that several modern-day financial centres in Europe, such as Luxembourg, Cyprus and Malta use worldwide service entities the exact same benefits to non-resident companies as the standard Caribbean "tax havens", but typically do not utilize the term offshore.

Nevertheless, that does not imply you do not need to follow laws where you are resident in regards to monetary coverage responsibilities. The privacy by having an overseas firm is not about hiding assets from the government, however concerning personal privacy and security from baseless suits, threats, spouses as well as other lawful disputes.

The term offshore and also confusion surrounding such firms are often connected with illegalities. Nevertheless, overseas companies imitate any typical firm yet are kept in various jurisdictions for tax obligation functions hence offering it benefits. This does not suggest it acts illegal, it's simply a way to optimize a company for tax obligation and protection purposes.

10 Easy Facts About Offshore Company Formation Described

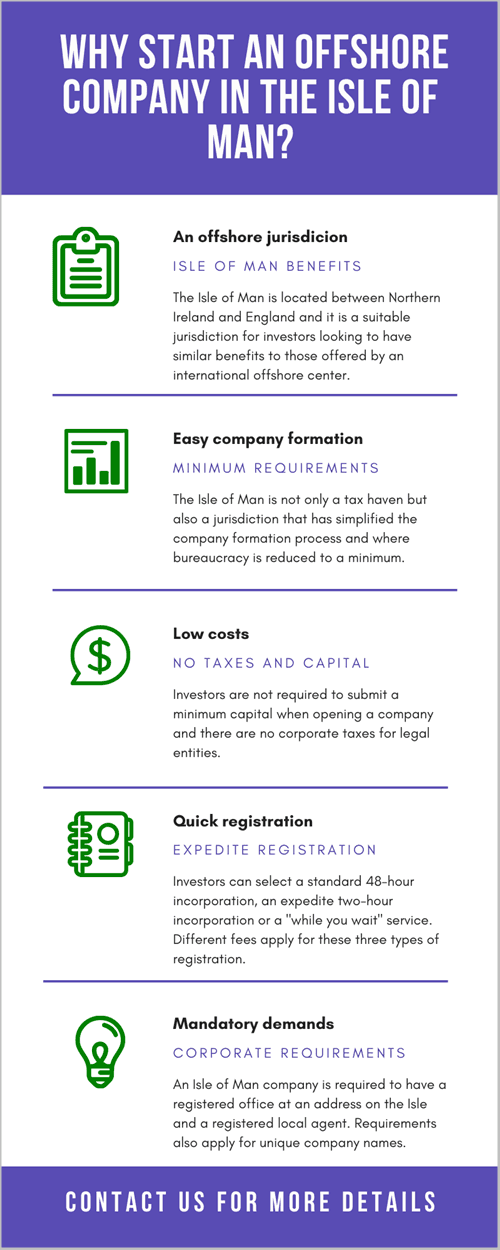

These are typically limiting requirements, high overheads as well as disclosure plans. Although any individual can begin a company, not every can get the same advantages. One of the most common benefits you will certainly locate are: Easy of enrollment, Very little costs, Flexible monitoring as well as minimal reporting demands, No fx constraints, Good neighborhood corporate regulation, High confidentiality, Tax obligation benefits, Minimal or no limitations in relation to service activities, Relocation possibilities Although it truly depends upon check this site out the legislations of your nation of residence and exactly how you desire to optimize his comment is here your company, generally on-line organizations and also anything that is not based on physical framework usually has the best benefits.

Activities such as the below are the most typical and helpful for offshore registration: Offshore financial savings and also financial investments Forex as well as stock trading, Shopping Expert solution firm Internet solutions Worldwide based business, Digital-based Company, International trading Ownership of copyright Your nation of home will ultimately specify if you can come to be entirely tax-free or otherwise (offshore company formation).

Although this checklist is not extensive and does not always relate to all jurisdictions, these are typically sent off to the enrollment workplace where you intend to register the business.

is a business which only performs financial tasks outside the nation in which it is registered. An offshore business can be any type of business which does not run "at house". At the very same time, according to popular opinion, an overseas find this company is any type of venture which appreciates in the country of enrollment (offshore company formation).

The Best Strategy To Use For Offshore Company Formation

Setting up an offshore company sounds challenging, but it worth the effort. An usual reason to establish an offshore company is to meet the legal demands of the nation where you desire to acquire residential property. There are several offshore territories. We constantly seek to discover. They all fulfill the really high requirements of, which are essential aspects in picking your offshore location.

Due to the fact that confidentiality is one of one of the most vital elements of our work, all information gone into on this type will certainly be kept strictly private (offshore company formation).

Also before going into information on how an offshore business is formed, we first require to comprehend what an offshore business truly is. This is a business entity that is formed and also runs outdoors your nation of home. The term 'offshore' in money refers to industrial techniques that are located outside the owner's national limits.